send link to app

OID Threshold Calculator app for iPhone and iPad

4.8 (

7808 ratings )

Business

Reference

Developer: Latham & Watkins LLP

Free

Current version: 1.3.0, last update: 2 years agoFirst release : 13 Mar 2017

App size: 57 Mb

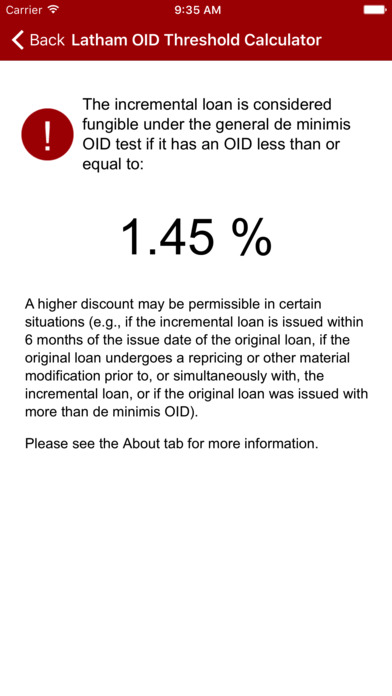

The following calculates the de minimis original issue discount ("OID") threshold for a typical loan or note that is required to pay regular cash interest at a single customary rate and fixed (or no) amortization on a quarterly basis. Depending on your specific situation, a result other than as calculated below may be appropriate. An incremental loan or tack-on note that is issued with less than de minimis OID and that has the same terms as the existing debt is generally considered tax fungible with the outstanding debt.